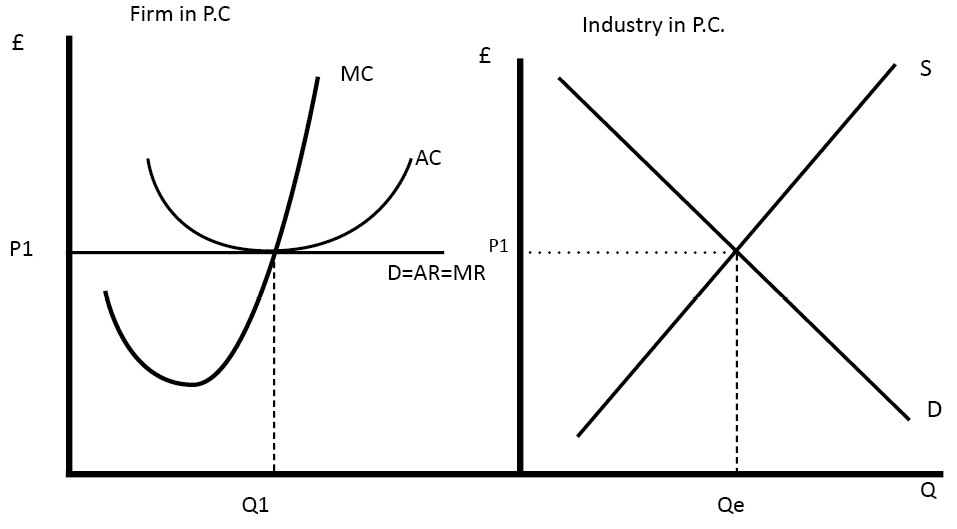

Sometimes a business fails because of poor management or workers who are not very productive, or because of tough domestic or foreign competition. Small Business Administration indicates that in 2011, 409,040 new firms “entered,” and 470,376 firms failed. When a business fails, after all, workers lose their jobs, investors lose their money, and owners and managers can lose their dreams. In the model of perfectly competitive firms, those that consistently cannot make money will “exit,” which is a nice, bloodless word for a more painful process. Unfortunately, not all businesses are successful, and many new startups soon realize that their “business adventure” must eventually end. They invest their money, time, effort, and many other resources to produce and sell something that they hope will give them something in return. Individuals start businesses with the purpose of making profits. The following Clear It Up feature discusses where some of these losses might come from, and the reasons why some firms go out of business.Ĭan we say anything about what causes a firm to exit an industry? Profits are the measurement that determines whether a business stays operating or not. The long-run process of reducing production in response to a sustained pattern of losses is called exit. But in the long run, firms that are facing losses will shut down at least some of their output, and some firms will cease production altogether. If a business is making losses in the short run, it will either keep limping along or just shut down, depending on whether its revenues are covering its variable costs. Losses are the black thundercloud that causes businesses to flee. When new firms enter the industry in response to increased industry profits it is called entry. If a business is making a profit in the short run, it has an incentive to expand existing factories or to build new ones. In a competitive market, profits are a red cape that incites businesses to charge.

The distinction between the short run and the long run is therefore more technical: in the short run, firms cannot change the usage of fixed inputs, while in the long run, the firm can adjust all factors of production. It varies according to the specific business. The line between the short run and the long run cannot be defined precisely with a stopwatch, or even with a calendar. Discuss the long-run adjustment process.Explain how entry and exit lead to zero profits in the long run.

0 kommentar(er)

0 kommentar(er)